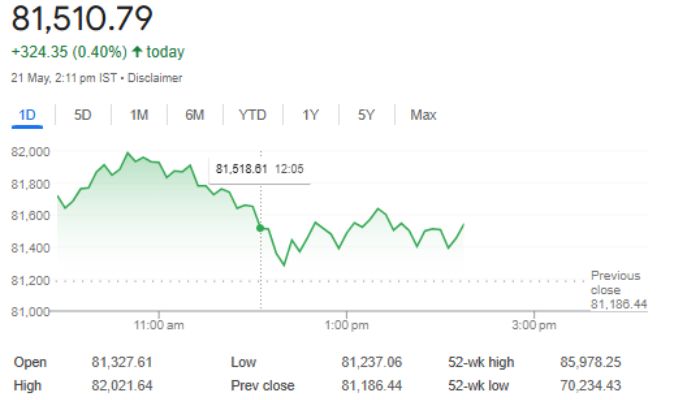

After facing losses for three consecutive sessions, the Indian stock market witnessed a remarkable rebound on Wednesday, May 21, 2025. Both benchmark indices — the Sensex and Nifty 50 — posted strong intraday gains, driven by a combination of technical, economic, and global factors. The Sensex surged over 800 points, while the Nifty 50 climbed more than 1%, adding nearly ₹4 lakh crore to investors’ wealth in a single day.

Here’s a closer look at the key drivers behind today’s market rally:

1. Short Covering in an Oversold Market

One of the primary reasons for the sharp uptick in stock prices today is short covering. Over the last three trading sessions, the Sensex declined by nearly 2%, making several high-quality stocks appear undervalued in the short term. Traders and institutional investors, sensing an opportunity, began covering their short positions, pushing stock prices higher. This buying momentum created a ripple effect across indices, especially in heavyweight stocks that influence the broader market.

2. Fall in the US Dollar Boosts Foreign Sentiment

The US Dollar Index (DXY) slipped by nearly 0.5% to trade around 99.60, which significantly influenced emerging markets like India. A weaker dollar generally bodes well for Indian equities as it encourages foreign institutional investors (FIIs) to increase their exposure to Indian stocks. Lower dollar strength makes emerging market assets more attractive, especially those with strong domestic fundamentals like India.

With improved global liquidity and a softening dollar, FIIs appear to have turned net buyers, adding to the bullish sentiment in today’s trade.

3. Positive Domestic Economic Indicators

Despite global uncertainties, India’s economic fundamentals remain strong. Analysts note that the overall market sentiment remains optimistic, with a strong macroeconomic outlook for the coming quarters.

Key supporting data include:

- GDP Growth: According to SBI economists, India’s Q4FY25 GDP is expected to grow at 6.4-6.5%, showcasing resilience amidst global headwinds.

- Inflation Control: India’s retail inflation in April fell to a six-year low, providing relief to consumers and businesses alike. This has also increased the possibility of further interest rate cuts by the Reserve Bank of India (RBI), which could support corporate earnings and investment.

- Earnings Outlook: With inflation cooling and the economy stabilizing, earnings from several sectors, especially banking, FMCG, and infrastructure, are expected to improve.

4. Optimism Around US-India Trade Deal

Markets are also closely watching developments surrounding a potential US India trade deal. Although details are still emerging, traders are optimistic that any positive outcome could boost bilateral trade and improve market confidence.

Additionally, Moody’s Ratings has reinforced this sentiment, stating that India is well-positioned to withstand negative effects from global trade disruptions due to its low dependency on exports and strong domestic demand.

The anticipation of a deal, coupled with Moody’s positive outlook, has added another layer of optimism to the market.

5. Technical Breakout Supports Momentum

From a technical standpoint, today’s surge was also backed by strong support and momentum indicators. Analysts say the Nifty 50 remains in a short-term uptrend as long as it stays above the 24,400 level. During intraday trade, the index crossed the critical 24,800 mark and moved toward 24,946.20, a sign of renewed bullishness.

Ajit Mishra, SVP of Research at Religare Broking, remarked,

“While the breach of the 24,800 mark dampened near-term sentiment earlier, today’s movement shows strength as long as the index holds above 24,400. Investors should remain cautious but not panic, and instead, focus on sector-specific opportunities.”

Market Outlook

With technical strength, easing inflation, positive economic data, and supportive global cues, the Indian stock market seems well-placed for a continued uptrend in the short term. However, experts advise maintaining a cautious approach and avoiding aggressive positions, especially ahead of any policy decisions or global developments.

Frequently Asked Questions

1. Why did the Sensex rise by over 800 points today?

The Sensex rose due to short covering, positive economic data, a fall in the US dollar, hopes of a US-India trade deal, and strong technical indicators.

2. How much wealth was added to the market today?

Approximately ₹4 lakh crore was added to investors’ wealth as the BSE market capitalization rose to ₹442 lakh crore.

3. What is short covering, and how did it affect the market?

Short covering occurs when traders buy back stocks they had sold earlier, expecting prices to fall. When markets don’t fall as expected, these trades are covered, pushing prices higher.

4. How does a weaker US dollar impact the Indian stock market?

A weaker dollar boosts foreign investment in emerging markets like India by making assets cheaper and more attractive for foreign investors.

5. Should investors buy now or wait?

Experts suggest a cautious approach. While the trend remains positive, investors should focus on fundamentally strong sectors and avoid aggressive buying until more clarity emerges.