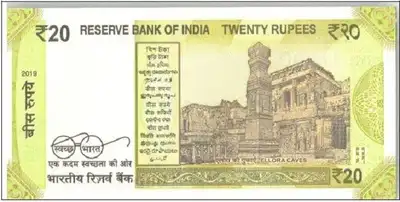

RBI the Reserve Bank of India announced that it will soon release a new version of the ₹20 currency note. Whenever there is a change in the RBI Governor, the RBI updates the notes regularly. The new ₹20 Notes will carry the signature of the current RBI Governor, Sanjay Malhotra, who took charge in December 2024.

The RBI has kept the design, size, and color of the note the same. It only updated the governor’s signature to keep the currency system current and aligned with official leadership changes.

This announcement means you will start seeing new ₹20 notes in circulation very soon, alongside the old ones.

Design and Continuity of Rs. 20 notes

The new ₹20 note will look exactly the same as the current one you use. The RBI has not changed the color, size, or design of the note.

Here’s What the RBI has kept the Same:

•Color: Greenish-yellow

•Size: 129 mm x 63 mm

•Design: The front side shows Mahatma Gandhi’s picture, and the back side displays the famous Ellora Caves

•Security Features: The RBI has kept all the existing safety features

The RBI has only updated the signature to that of the new Governor, Sanjay Malhotra. They do this as a normal process whenever a new Governor takes charge.

So, except for the signature, the RBI has kept everything else about the ₹20 note just like before.

Governor’s Signature Update on Rs.20 notes

Signatures of current RBI Governor are required on all Indian banknotes, which shows that the note is officially approved by the Reserve Bank of India.

Recently, Sanjay Malhotra became the new RBI Governor on December 11, 2024. So now, all newly printed currency notes — including the ₹20 note — will have his signature on them.

This is a normal and routine change that happens whenever a new Governor is appointed. It does not affect the value or use of older notes with previous Governors’ signatures.

So, when you see a ₹20 note with Sanjay Malhotra’s signature, you’ll know it’s one of the newly printed ones — but both old and new notes are equally valid.

Are all old Rs.20 notes still valid?

Yes, you can still use old ₹20 notes completely even after the new ones get published.

The Reserve Bank of India (RBI) has clearly confirmed that all old ₹20 notes — including those with signatures of earlier Governors — will continue to serve as legal tender. This means:

•You can use them to buy things.

•You can deposit or withdraw them from banks.

•No one can refuse to accept them.

The RBI issues new ₹20 notes with the latest Governor’s signature as part of a regular update. Both old and new notes will circulate together in the market. So, you don’t need to worry or exchange your old ₹20 notes because they remain valid for use.

Circulation Plans of new Rs. 20 note

The new ₹20 banknotes with Governor Sanjay Malhotra’s signature will enter circulation very soon.

Let’s talk how people will receive the new notes:

•The RBI will send the new notes to banks across the country.

•Banks will distribute these notes to customers through cash withdrawals, over-the-counter transactions, and ATMs.

•Shopkeepers may also give you the new notes as change while shopping.

The RBI has instructed banks to prepare their machines and equipment to handle the new notes smoothly.

You may start seeing more of these new ₹20 notes in your daily transactions within a few weeks. They will gradually become more common in your wallet.

Meanwhile, people will continue to use old ₹20 notes along with the new ones. So, there will be no shortage or sudden disruption for anyone using ₹20 notes.

Important advices for citizens using new Rs. 20 note

The Reserve Bank of India wants everyone to follow a few important points about the new ₹20 notes after its circulation:

•Keep using your old ₹20 notes without any worry, as they still hold value and everyone accepts them.

•Citizens must check the new ₹20 notes you receive are clean and free from damage.

•Citizens must contact their bank or the RBI immediately if you face any issues while using old or new ₹20 notes.

•Get ready to use old and new ₹20 notes in circulation, as banks will start distributing the new ones soon.

•Always check for security features like the watermark and the security thread to avoid accepting fake notes.

By following these simple steps, you can handle ₹20 notes safely and with confidence.

Conclusion

The Reserve Bank of India has released new ₹20 banknotes with Governor Sanjay Malhotra’s signature as part of a normal and routine update. The RBI makes this change every time a new Governor takes charge.

The RBI has not changed the design or value of the ₹20 note — it has only updated the Governor’s signature. Both old and new ₹20 notes remain equally valid and accepted for all types of transactions.

No one needs to worry about the exchange of old ₹20 note as they will continue to be legal For long time

The RBI is managing the transition to the new notes smoothly, allowing everyone to keep using ₹20 notes without any problems.

In short, the RBI has made a simple update — there’s nothing to be concerned about. You can keep using ₹20 notes as usual, whether they carry the old or the new Governor’s signature.

Also Read : An Ultimate Guide To Building A Secure Mobile Banking App

Frequently Asked Questions

1. Why is the ₹20 note being updated?

The update is a routine change by the RBI. A new ₹20 note is being issued to reflect the signature of the new RBI Governor, Sanjay Malhotra, who took office in December 2024.

2. Has the design or color of the ₹20 note changed?

No. The design, color (greenish-yellow), and size (129 mm x 63 mm) remain exactly the same. Only the Governor’s signature has been updated.

3. What is the difference between the old and new ₹20 notes?

The only difference is the signature. The new note carries the signature of Governor Sanjay Malhotra. All other features remain unchanged.

4. Are old ₹20 notes still valid?

Yes, all old ₹20 notes with signatures of previous Governors remain valid and are legal tender. You can continue using them without any issue.

5. Do I need to exchange my old ₹20 notes?

No. There is no need to exchange old notes. They remain fully valid for transactions and banking purposes.