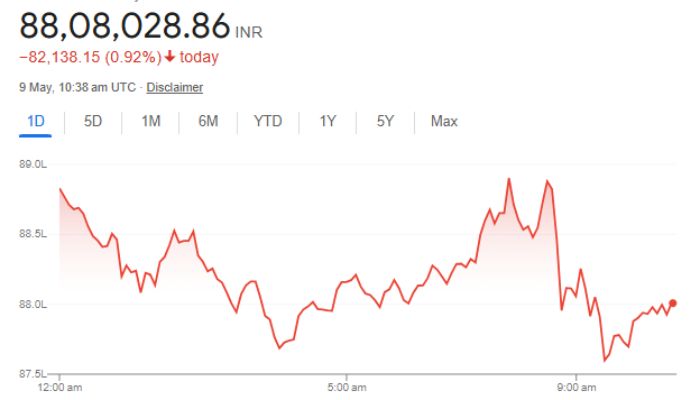

An amazing comeback has seen Bitcoin stupendously retaking the much-coveted $100,000 price barrier after nearly five months since this barrier was surrendered in February. A key trade agreement between the United States and the United Kingdom has brought optimism to global markets. This resurgence of the cryptocurrency denotes that investors have been straying towards growing confidence as yet another opportunity for undervalued-out-of-the-way duration ensues with the calming of some geopolitical tensions.

Bitcoin’s Rally: A Sign of Renewed Market Confidence

On Thursday, Bitcoin surged past the psychological 100,000threshold,reaching100,000threshold,reaching101,329.97—a 4.7% gain in a single day.

The news of a “breakthrough deal” between the U.S. President Donald Trump and British Prime Minister Keir Starmer partly drove the rally. The agreement holds a 10% tariff on UK goods entering the U.S., while tariffs imposed by the British onto the American imports getting lowered from 5.1% to 1.8%. This, in turn, implied a possible exit from escalating global trade tensions; thereby, supporting market sentiments from both traditional and digital fronts.

Ethereum Joins the Rally, Surging Over 14%

Bitcoin was not the only cryptocurrency that, with the bullish momentum in place, flew pretty high. Ether breached a $2,000 barrier at an intra-day of $2,050.46, having appreciated through 14%. That was its highest price since late March. It goes to show how macroeconomic developments tend to trickle and affect the entire spectrum of cryptocurrencies.

Ethereum has been strong in its performance with the rising interest in institutional DeFi and blockchain-based applications. With clearer regulations and more adoption, Ethereum so-to-speak has big shoes to fill in being the major platform for smart contract development and distributed applications (dApps).

Why Trade Deals Matter for Bitcoin

When the risk of trade war or geopolitical uncertainty increases, investors tend to flock to so-called “safe haven investments”-gold being one of them, and Bitcoin being the other. On the other hand, when the uncertainties decline, optimism pumps back into speculative investments in risk assets like cryptocurrencies.

The U.S.-UK trade deal signals a potential thaw in global trade relations, reducing uncertainty for businesses and investors.

Bitcoin’s Long-Term Outlook: Bullish or Cautious?

Despite the recent rally, Bitcoin’s price remains volatile, and analysts are divided on its near-term trajectory. Some key factors influencing its future performance include:

1. Institutional Adoption

Major financial institutions, including hedge funds and corporations, continue to integrate Bitcoin into their portfolios. The approval of Bitcoin ETFs and growing interest from pension funds could further drive demand.

2. Regulatory Developments

Governments worldwide are working on clearer crypto regulations. While stricter rules could dampen speculation, well-defined policies may encourage institutional participation.

3. Macroeconomic Conditions

Interest rates, inflation, and global liquidity conditions play a crucial role in Bitcoin’s price movements. If central banks pivot toward rate cuts, risk assets like Bitcoin could see further upside.

4. Technological Upgrades

Bitcoin’s ongoing developments, such as the Lightning Network for faster transactions, could enhance its utility as a payment system, attracting more users.

Conclusion: A Turning Point for Crypto?

The return of Bitcoin to $100,000 represents considerable respectability and revived sentiments in traditional and digital markets. While the U.S.-UK trade deal has indeed served as a catalyst, the month-to-month to year-after growth in ABTC will depend on the bigger economic trends, the regulatory clarity, and the awareness of adoption by the people.

Frequently Asked Questions (FAQs)

1. Why did Bitcoin’s price surge past $100,000 recently?

Bitcoin’s recent rally to $101,329.97 was largely driven by optimism surrounding a new U.S.-UK trade agreement, which eased global market concerns. The reduction in tariffs signaled a potential de-escalation in trade tensions, boosting investor confidence in both traditional and digital assets.

2. How did Ethereum perform during Bitcoin’s rally?

Ethereum joined the upward trend by surging over 14%, reaching $2,050.46, its highest level since March. The rise was fueled by broader crypto optimism and growing interest in institutional DeFi and blockchain-based applications.

3. Why are trade agreements important for the cryptocurrency market?

Trade agreements help reduce geopolitical uncertainty, which often influences investor behavior. A stable trade environment can shift investor sentiment from risk aversion to confidence in speculative assets like cryptocurrencies, driving prices upward.

4. What are the key factors affecting Bitcoin’s long-term outlook?

Bitcoin’s future depends on several factors, including:

- Institutional adoption (ETFs, hedge funds, pension funds)

- Clearer regulations from governments

- Global macroeconomic conditions like interest rates and inflation

- Technological improvements such as the Lightning Network

5. Is Bitcoin still considered a safe haven asset?

Bitcoin is increasingly viewed as a digital safe haven similar to gold. During periods of market instability, investors may turn to Bitcoin to hedge against fiat currency risks. However, its high volatility also means it’s favored by risk-seeking investors when economic sentiment improves.