For retirees who want to take systematic withdrawals from their mutual fund investments, SWP is a good choice. Discover which five SWP Mutual Funds are the best in India. When the mutual fund scheme’s NAV drops and market conditions deteriorate.

As of May 27, 2025, the BSE Sensex is up 4.4% for 2025.

Due to large economic, trade and geopolitical threats, the markets have been quite uncertain. In such a situation, it is difficult to defeat the market. If you want to perform better than the benchmark, it is necessary to choose the appropriate mutual fund scheme.

Making informed decisions could also help you reach financial objectives like retirement.

The mutual fund’s systematic withdrawal plan (SWP) is one instrument you might employ in this respect.

What is SWP Mutual Funds?

The systematic withdrawal plan, or SWP, is a feature of mutual funds that enables investors to take money out of their mutual fund schemes. This is usually completed within a few days on a monthly, quarterly, or semi-annual basis. The return amount may be variable or fixed.

The amount that has been withdrawn generates periodic income, and the remaining amount that has not yet been withdrawn continues to generate returns; in other words, there is a chance that your capital will increase in addition to the SWP income.

Cash flow is provided by the methodical and controlled withdrawal process, which eliminates the need to sell and withdraw your mutual fund investment.

How SWP Mutual Funds Works?

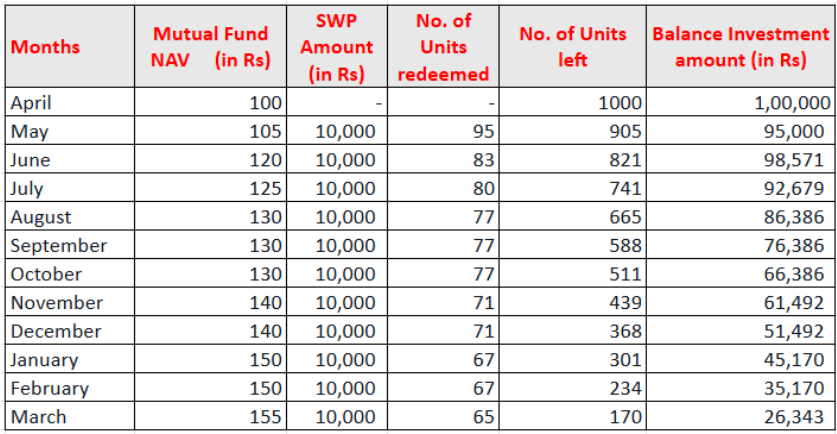

Let’s say you want to take out Rs 10,000 every month in a methodical manner from an investment worth Rs 1 lakh.

It operates as shown in the table below.

Fewer units will be removed while the NAV is higher, and vice versa.

With each monthly withdrawal, the market value (NAV) of the units you take out dilutes your investment in the fund.

You will continue to receive returns from the remaining mutual fund units.

Even if SWPs are thought to be advantageous, you should take the state or direction of the market into account. SWPs typically work to your advantage in erratic markets that are trending upward.

You wind up redeeming more units to make a systematic withdrawal when market circumstances deteriorate and the mutual fund scheme’s net asset value (NAV) drops, which could cause the fund’s corpus to run out sooner than anticipated.

SWP is therefore crucial for systems that have a solid and steady track record. Doing an SWP from the scheme itself might not make sense if it is not constantly operating effectively.

Which Are the Top SWP Mutual Fund Schemes?

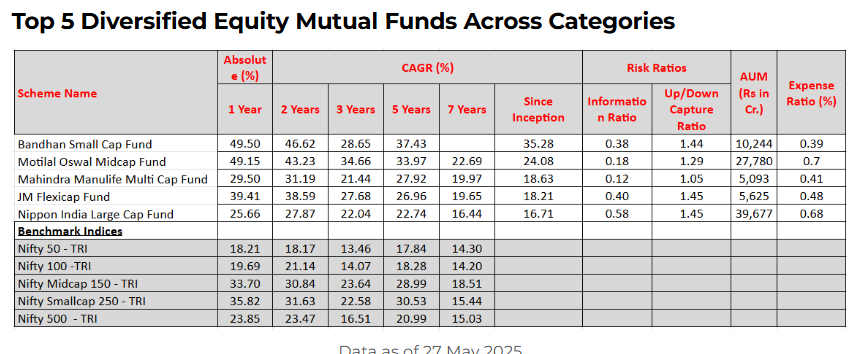

The best-performing diversified equity-oriented mutual fund schemes in each of the significant subcategories are given here.

Since rolling returns smooth out volatility and offer smoothed returns throughout the selected period, we have taken them into consideration rather than point-to-point returns when evaluating mutual fund returns over an extended holding period.

Top 5 Diversified Equity Mutual Funds Across Categories

On a risk-adjusted basis, the schemes in the above table rank among the best-performing schemes over extended periods of time. These schemes have made their investors rich with superior underlying portfolios.

They have beaten their respective benchmark indices and done well during both bull and bear market periods.

Who Should Consider SWP?

SWPs are appropriate for investors seeking cash flows for upcoming expenses or retirees in need of a steady income stream.

Keep in mind that the investment corpus lasts less time when the withdrawal rate is high than when it is low. The question of what the appropriate withdrawal rate should be has no clear solution.

You have to be careful not to withdraw too much. If not, you run the risk of outliving the funds required to cover your retirement costs.

What About the Tax Implications of SWP?

The net gains from a debt mutual fund scheme from which you are making regular withdrawals will be included in your gross total income (GTI) and subject to taxation in accordance with your income tax bracket. Since withdrawals are considered redemptions, they are taxable as capital gains.

If you remove your stock mutual fund profits within a year of the investment date, they are considered Short Term Capital profits (STCG) and are subject to 20% tax.

Gains beyond Rs 1.25 lakh in a fiscal year are considered Long Term Capital Gains (LTCG) and are subject to 12.5% taxation if the investment is withdrawn after a year.

Conclusion

Despite market volatility, the SWP option can give you consistent cash flow with methodical withdrawals.

It eliminates the need to time the market while making withdrawals. Compounding and rupee-cost averaging are also advantageous to you.

However, remember that the mutual fund’s NAV may decrease during protracted downturns or bad market periods, and that the investment value may be exhausted sooner than anticipated with SWP.

Consider your needs, the state of the market, and whether choosing SWP is really worthwhile.

Also Read : India Become 4th Largest Economy Globally, Japan At 5th

Frequently Asked Questions

1. What is an SWP in mutual funds?

An SWP (Systematic Withdrawal Plan) is a mutual fund feature that allows investors to withdraw a fixed or variable amount from their investments at regular intervals (monthly, quarterly, etc.), generating consistent cash flow.

2. Who should consider investing in SWP mutual funds?

SWPs are ideal for retirees or individuals seeking a steady income from their investments. They are also suitable for those planning for future expenses like children’s education, EMIs, or healthcare.

3. How does an SWP work?

In an SWP, mutual fund units are sold at regular intervals to generate the withdrawal amount. When NAV is high, fewer units are sold; when NAV is low, more units are redeemed. The remaining units continue to grow with market returns.

4. What happens if the market conditions are poor during an SWP?

If the market underperforms and the NAV drops consistently, more units will be redeemed to maintain the same withdrawal amount, which could lead to faster depletion of the investment corpus.

5. What are the benefits of using SWP?

* Regular income stream

* Helps manage cash flow during retirement

* Avoids timing the market

* Takes advantage of compounding and rupee cost averaging

* Suitable for tax-efficient withdrawals