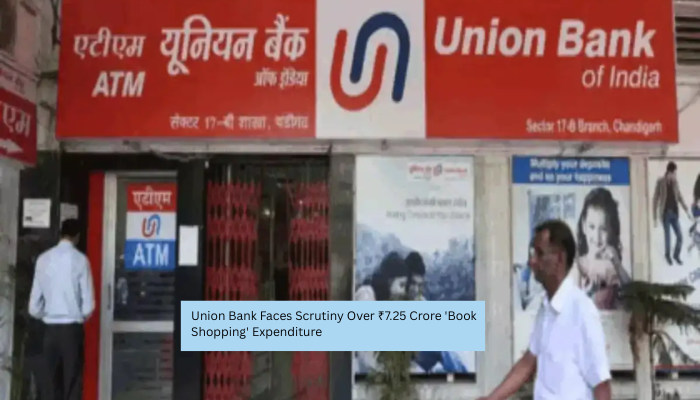

Union Bank of India, a prominent public sector lender, has come under the scanner after revelations surfaced regarding a highly unusual and extravagant expenditure of ₹7.25 crore on a single book. According to a detailed report by The Economic Times, the Union bank spent this hefty amount to purchase nearly 2 lakh copies of the book India@100: Envisioning Tomorrow’s Economic Powerhouse, authored by Krishnamurthy V Subramanian, India’s former Chief Economic Adviser (CEA).

The move, which appears to be more promotional than educational, has drawn considerable scrutiny due to the timing, scale, and purpose of the purchase. The book, published in August 2024, was reportedly bought in bulk even before its official release. The justification offered by the bank for this massive order was that the books were meant to be distributed among “customers, local schools, colleges, libraries, and others” as part of outreach and educational initiatives.

However, this justification has not appeased critics or regulators. What raises eyebrows further is the author’s connection to the government and financial institutions. Subramanian served as CEA from 2018 to 2021 and was later appointed as India’s executive director nominee at the International Monetary Fund (IMF). His IMF tenure, however, was recently cut short—reportedly due, at least in part, to irregularities associated with the promotion and distribution of his book.

The Details Behind the Book Purchase

As per documents reviewed by The Economic Times, the procurement of the book was initiated through two inter-office letters circulated within Union Bank’s central offices in June and July 2024. These letters, sent by the bank’s support services department, instructed all 18 zonal offices to procure specific quantities of the book. Each zonal office was to acquire 10,525 copies of the paperback version, priced at ₹350 per unit, and a smaller number of hardcover versions at ₹597 each.

This added up to a total procurement of 189,450 paperback copies and 10,422 hardcover copies. The combined purchase cost was ₹7.25 crore—a significant outlay for any public institution, let alone a government-owned bank operating in a sector often under pressure for prudent financial management.

The book’s content discusses India’s economic prospects as it approaches its centenary of independence in 2047. While this theme aligns with national interests and economic policy discourses, critics argue that a public sector bank sponsoring and distributing the book in such large quantities—without competitive bidding or proper evaluation—sets a dangerous precedent. It blurs the lines between institutional responsibility and personal promotion.

Concerns Over Conflict of Interest And Oversight

The connection between the book’s author and the bank’s decision-makers has raised concerns over a potential conflict of interest. Subramanian, while no longer in an official position within the Indian government, remains an influential figure in financial and policy circles. His abrupt exit from the IMF has further fueled suspicions that the book deal and other alleged irregularities may have played a role in his premature removal.

Furthermore, the lack of transparency in the decision-making process has drawn criticism from financial watchdogs and civil society. There is little evidence of any formal tender process, competitive pricing, or independent review prior to the bank committing crores of rupees to this initiative. In the absence of a public procurement framework or third-party evaluation, the entire transaction risks being viewed as an example of misuse of public resources.

Critics also point to the fact that this type of expenditure may not align with the bank’s core mandate, which is to ensure responsible financial services and economic development, not to promote personal publications. There is also ambiguity about the actual distribution and impact of these books—whether they reached the intended audiences and how they were received.

Government and Regulatory Response

While no official statement has been made by the Ministry of Finance or the Reserve Bank of India as of yet, the issue is reportedly on the radar of regulatory authorities. Internal reviews may soon be initiated to evaluate not just this specific transaction, but the broader governance practices within Union Bank.

This development comes at a time when public sector banks are being encouraged to tighten oversight, reduce non-performing assets, and maintain high standards of accountability. In this context, the use of ₹7.25 crore for promotional distribution of a book—however relevant its content may be—has prompted calls for policy reform in how such decisions are made and approved.

Broader Implications for Public Sector Governance

This incident also highlights a broader issue of governance within public institutions. When high-ranking officials or politically connected individuals are perceived to benefit from state resources—either directly or indirectly—it can erode public trust. The line between public service and private gain must be carefully maintained, especially in sectors like banking that are built on public confidence.

Moreover, in an era where fiscal prudence is being emphasized across government institutions, any expenditure that appears to deviate from this principle can quickly become a flashpoint. For Bank, which has otherwise been known for its relatively stable operations, this controversy represents a reputational risk that could affect its relationship with customers, investors, and regulatory bodies.

What Lies Ahead

As the investigation progresses, key questions will need to be answered. Who within Union Bank approved the purchase, and under what authority? Was there any pressure or influence from outside stakeholders, including government officials or the author himself? Were alternatives considered, such as educational programs or customer engagement efforts that did not involve such heavy spending?

Until these questions are addressed transparently, the controversy will likely continue to simmer. For now, the incident serves as a cautionary tale for other public sector entities about the importance of due diligence, transparency, and maintaining a clear boundary between professional decision-making and personal interest.

Also Read: Bank RoA To Dip By 10-20 Bps In FY26 Despite Repo Rate Cuts